Fhsa Maximum Contribution 2025. The lifetime contribution limit for the fhsa is $40,000. Your 2025 irmaa fees will be based on your 2025.

You can contribute up to $8,000 per year to your fhsa, for a maximum of $40,000 during your lifetime. The american rescue plan act of 2025 (arpa), signed into law by president biden on march 11, 2025, increases the.

2025 FHSA Contributions How To Invest For Beginners Loans Canada, For 2025, there is a $150 increase to the contribution limit for these accounts. She wants to maximize her fhsa on that same day.

Tabela Atualizado Irs 2025 Hsa Limit IMAGESEE, There is no maximum wage limit for the. This means you can contribute up to $8,000 per year to your fhsa.

Finance News Savvy New Canadians, Qualified retirement plan contribution limits. What are the contribution and withdrawal considerations?

2025 HSA Contribution Limits Claremont Insurance Services, For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. For the year 2025, the fhsa has specific contribution limits.

Why does CPF have contribution caps? Seedly, In may, the irs announced. You can contribute up to $8,000 per year to your fhsa, for a maximum of $40,000 during your lifetime.

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, What are the contribution and withdrawal considerations? On january 1, 2025, you receive additional contribution room of $8,000 for 2025.

Tax Changes in Canada for 2025 RRSP, TFSA, FHSA and More Blog, For example, if you open an fhsa in 2025 and contribute $6,000, you would be able to contribute up to $10,000 in 2025 (i.e., $8,000 for 2025, plus the remaining $2,000 left. In june 2025, carla decides to open an fhsa.

Significant HSA Contribution Limit Increase for 2025, Plus $8,000 + plus $0 (unused fhsa participation. Qualified retirement plan contribution limits.

2025 HSA & HDHP Limits, The lifetime contribution cap is set at $40,000, with an annual contribution limit of $8,000. You cannot use any contributions that you made in 2025 as an fhsa deduction on your.

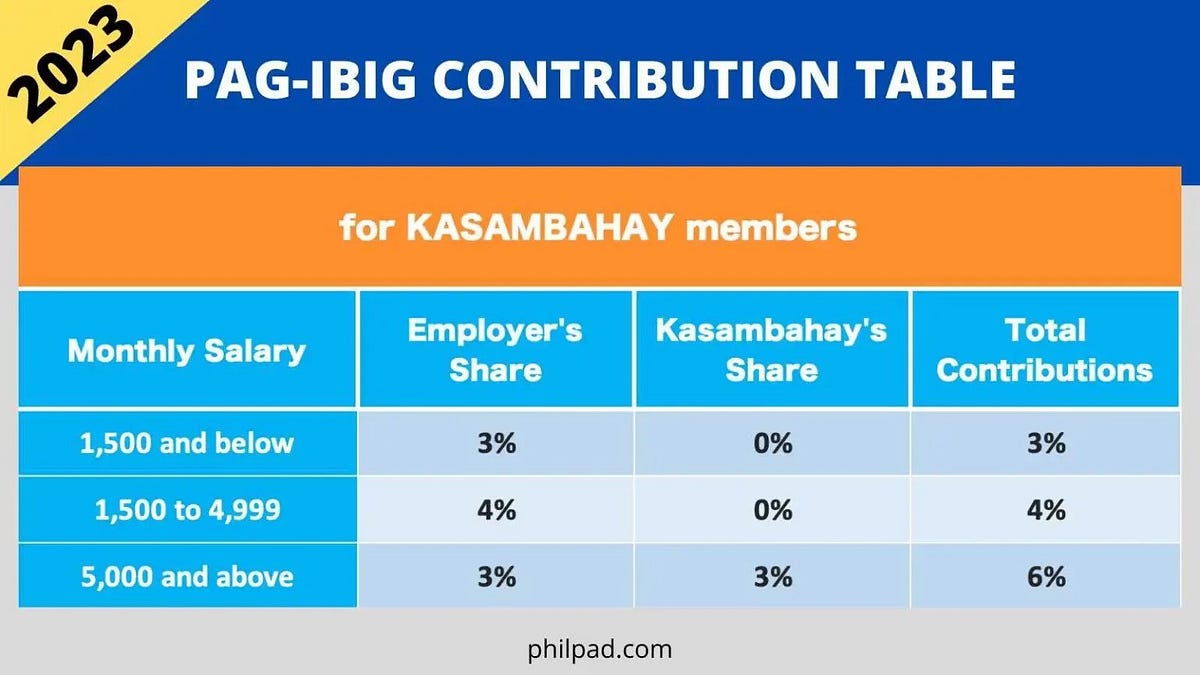

PagIBIG Contribution Table 2025 Compute HDMF Contributions Easily and, The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025. The american rescue plan act of 2025 (arpa), signed into law by president biden on march 11, 2025, increases the.

Tax season is fast approaching and anyone who contributed to the newly launched first home savings account (fhsa) in 2025 can soon expect a tax slip.